We get it - you are eager to move into your new home, and can’t wait to start decorating the place. The bad news is that, whether you are buying for the first time or moving home, the house buying process in the UK is far from short. The time to buy a house, from house selling to moving in, can take anywhere from a couple of weeks to months.

The good news is that, if you want to know how long it takes to buy a house, this guide will run you through an average home buyer's timeline, as well as answer the question - how fast can you buy a house and move in?

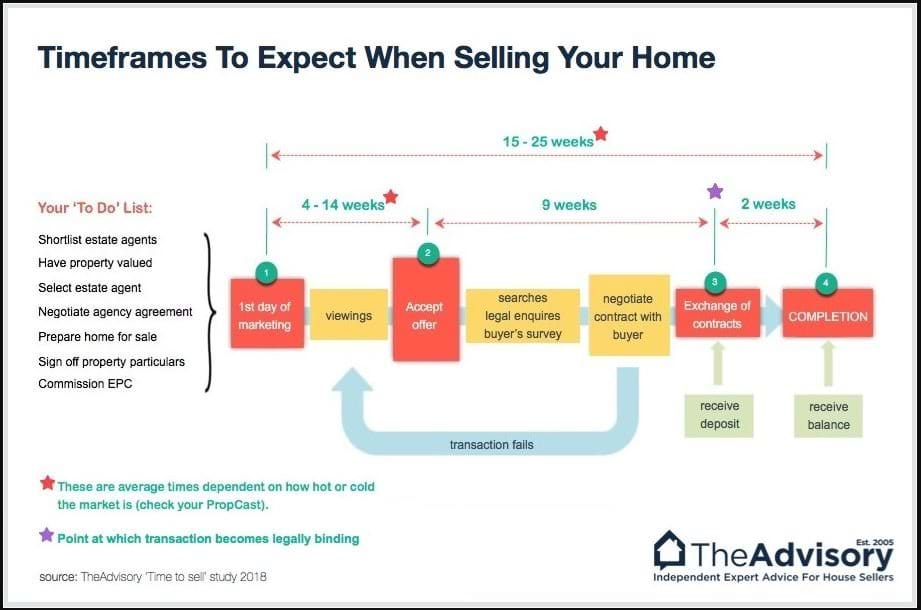

Infographic on average time it takes to buy a house - The Advisory

How long does it take for a sale of a house to go through?

Before you get into the business of buying a new house, chances are you will have to begin the stages of selling a house you currently own. Having money from a sale will make the buying process much easier, and will help reduce how long a house sale should take.

If this is the case, it’s a good idea to clean up your current house so it is as tidy as possible, and potentially order a removal service to help with moving any furniture you want to keep. Next, you will need to get the house valued to get a sense of how much money you should be getting. This can be done by either going online to check how much similar properties are being sold or recruiting a couple of estate agents to give you a rough estimate.

You can sell your house yourself, but if you want to avoid the hassle, and have enough money in the bank, you might want to get an estate agent to handle this for you as well. Ask your friends and family if they know a good agent, or scour the internet to find the agent with the best performance in your neighbourhood. Waiting for the right offer is one of the shortest stages of the moving house timeline, taking an average of 30 days in the UK.

Read the Complete Home Moving Checklist

How long does a mortgage application take?

If you are taking out a mortgage for your new home, this is probably one of the longest stages in the house buying process timeline. Getting a mortgage on a property will require you to save up a deposit (usually around 10%) and then borrow the remainder of the money for the house from a bank, which will give you an offer that outlines how much you pay back on a monthly basis. Your lender will need to know the ins and outs of your financial situation, including your credit score and how much you earn.

How long does the mortgage approval take? This will likely depend on the strength of your application and financial position, but all being well, your application should be approved in around 6 weeks.

It may feel like the house buying process is taking forever, but as there are often high interest rates associated with mortgages, patience is a virtue! If you rush into a deal without considering it properly, you may end up with very high repayments.

Once you have a suitable offer from your lender, the offer lasts around 3-6 months, giving you plenty of time to find the right house for you.

Process of buying a house

Of all of the steps to buying a house in the UK, deciding on your dream house might be the most enjoyable part of your house buying journey. Before you can do this though, consider your financial situation, and establish how much you are able to spend on a new property, particularly if your circumstances suddenly change. Once you have a number in mind, take your time to make sure you find the right place for you, and arrange plenty of house viewings to get a sense of what is available. You may already have an idea of what area you want to live in, so confine your search to this particular area, using the help of the internet and potential estate agents to reach a decision.

After searching far and wide, you will likely know the moment when the right property has caught your eye. After deciding how much you can spend - taking into account how much you will need for furniture and appliances - it is time to make an offer. If you have hired a solicitor this is where he or she will come into play.

Your solicitor will arrange the contracts and finalise the process of conveyance - the legal transfer of property ownership. Until an offer is agreed and these documents are signed, try not to get too attached to your new home to avoid disappointment - it is possible that a third party with a higher offer could swoop in and take the property from your clutches.

Once the paperwork has been finalised, and your moving date confirmed, it is time to relax and think about the possibilities of your new home. The house buying process in England may be a lengthy one, but by carefully following the steps of buying a house, you are much more likely to land a home that puts a smile on your face.

Ready to begin your buying journey?

Are you a first time buyer looking to get on the property ladder and buy the home of your dreams? At Peabody, we have a number of new homes throughout London and the South East available through Shared Ownership or Rent to Buy.

FIND A HOME