Not all postcodes are created equal when it comes to house prices. In recent years, many people have found themselves progressively priced out of the buying market, and in certain cases, of the rental market as well. Peabody New Homes compares the cost of a square foot of property in different parts of England.

How much house can I afford in London?

It’s not a surprise that affording a house in the capital isn’t accessible to most people. The price for one square foot in inner London averaged £724 in 2023, and unfortunately, fewer boroughs offer competitive prices when buying outright.

When looking to buy in the capital, prospective homeowners will have to compromise on how much space they will get for their money. If you were to pay the current English average house price for a London property, you'd be buying a 366 square home which is slightly below the average size for a one-bed home

What London boroughs are the most affordable?

If finding a way to live in the capital without breaking the bank is a challenge, there are still a few areas that you can target. When stepping onto the property ladder, 7 boroughs on the outer edges offer properties below the city average.

You can find a home:

- 31% below the London average in Barking and Dagenham

- 16% below in Newham

- 12% below in Havering and Croydon

- 8% below in Bexley

- 7% below in Sutton

- 2% in Hillingdon

For people looking to buy their first home outright, Barking and Dagenham offers an average property price of £344,518 (from 2023 data) which is well below the London average of £532,000.

To assess housing affordability, it can be useful to look into the affordability ratio of an area. This corresponds to the number of times buyers will be spending their annual earnings to buy a home. When considering that the median earnings in London is £44,370, the affordability ratio for Barking and Dagenham is 7,76 compared to 12 for the average London house price.

How much house can I afford across England?

Data from Twenty EA revealed the stark gap between house prices across different areas of England. Unsurprisingly, Outer London has the second most expensive square foot price with £572. When it comes to other parts of the country, the South East is the region that offers the least value for money with £435 for one square foot.

East of England and South West give a similar value to buyers with £381 and £371 for one square foot.

To go below £300 for a square foot, prospective homeowners will have to look into homes in the West Midlands (£276/sqft), East Midlands (£270/sqft), the North West (£237/sqft) and Yorkshire and the Humber (£227/sqft).

What is the cheapest area to buy in England?

For those looking for the most space without spending too much, heading up north is a smart move. The North East, not too far from Scotland, offers the cheapest homes in the country right now. You'll find that, on average, each square foot costs about £170 here.

And it's not just the prices that make the North East appealing. Houses in this region are quite roomy, averaging around 748 square feet each. This means that the average house price in the area is about £127,160.

Why are houses so unaffordable?

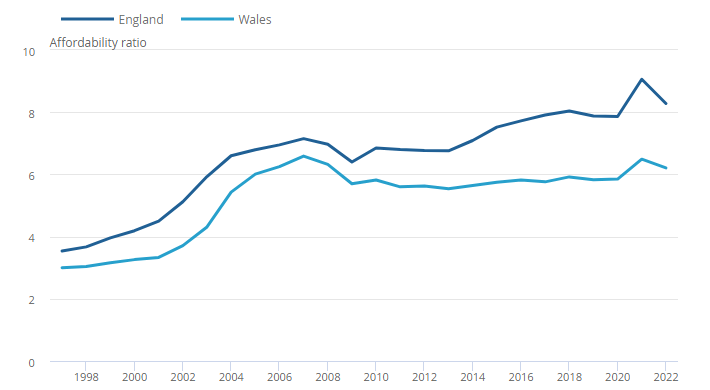

Incomes have increased in the last 25 years but not quite at the same pace as house prices have increased. The reason why previous generations were able to buy a house without as much difficulty is because their was a smaller difference between their annual salary and the cost of a house. The ONS highlighted in its 2022 Housing affordability in England and Wales report that "full-time employees in England could expect to spend around 8.3 times their annual earnings buying a home."

Evolution of the housing affordability ratio according to the ONS

What is the housing affordability crisis caused by?

Several factors contribute to the housing affordability crisis. One major factor is the imbalance between housing supply and demand, particularly in highly desirable urban areas like London. Limited availability of land for development, coupled with strict planning regulations, has restricted the construction of new housing units which only worsens the situation.

The issue of housing affordability is linked to broader economic trends, such as low interest rates and a growing population. Low interest rates make borrowing more attractive, driving up demand for housing loans and consequently pushing prices higher.

Government policies and taxation also play a significant role in shaping housing affordability. Measures such as stamp duty, planning regulations, and housing benefit policies influence both the demand and supply sides of the housing market, impacting prices and accessibility for prospective buyers and renters alike.

As the housing affordability crisis persists, alternative ways to buy are being offered to people who cannot afford to buy a home outright. Prospective buyers can look into Shared Ownership to step onto the property ladder without needing a bigger salary. Another option for Londoners is London Living Rent which allows people to pay less rent in order to save enough money for a deposit to then buy.